Banks are failing, but do Defense Tech companies care?

Exploring the impact of SVB’s failure last week on Defense Tech

Typically, Wednesday editions of Building Our Defense focus on the intersection between venture capital and defense.

This week, I’m departing from our regularly scheduled programming to dive into the impact of the second largest bank failure in U.S. history on defense tech startups and VC investments into defense.

Wait, Bank Failure?

I know many readers are plugged in to what’s happening in Silicon Valley and are likely aware about the events of the last week.

But not everyone may be up to date, so this will be a very brief, high-level overview of what happened and where we are now.

Silicon Valley Bank—or SVB— was founded in 1983, to provide banking services to startups.

Over forty years, SVB grew to be the 16th largest bank in the United States, and the bank of choice for venture capitalists, startups, and other technology companies. In fact, more than half of all VCs and startups banked with SVB

Banks make money by taking deposits and reinvesting a significant portion of that money into other mechanisms that earn higher interest than the bank pays out to its depositors. Essentially, there’s an interest rate arbitrage.

During the period of extended low interest rates, SVB invested money in long-term accounts with locked-in rates. Then interest rates rose, causing an inversion (i.e., SVB is losing money on its investments relative to the money it owed depositors).

Last week, SVB announced plans to raise $2B to bolster its balance sheet and ensure solvency.

Unfortunately, this announcement triggered fear in several high-profile VC firms that then encouraged their portfolio companies to withdraw some or all of their money from the bank.

This led to a run on the bank, and the FDIC stepping in a take over.

When the FDIC takes over a bank, they like to do so on a Friday as it gives them the weekend to sort through the mess, while markets are closed, to mitigate contagion.

Fortunately, the FDIC was able to do this and determined that it could auction off SVB assets and holdings sufficiently to allow depositors to access 100% of the money that SVB held (this is notable, as FDIC only insures up to $250,000 AND only ~2-3% of deposits at SVB were thus insured).

All’s well that ends well?

It’s fair to ask “what’s the big deal?” if everyone has gotten their money back. In other words, all’s well that ends well, right?

Not exactly.

There are several considerations.

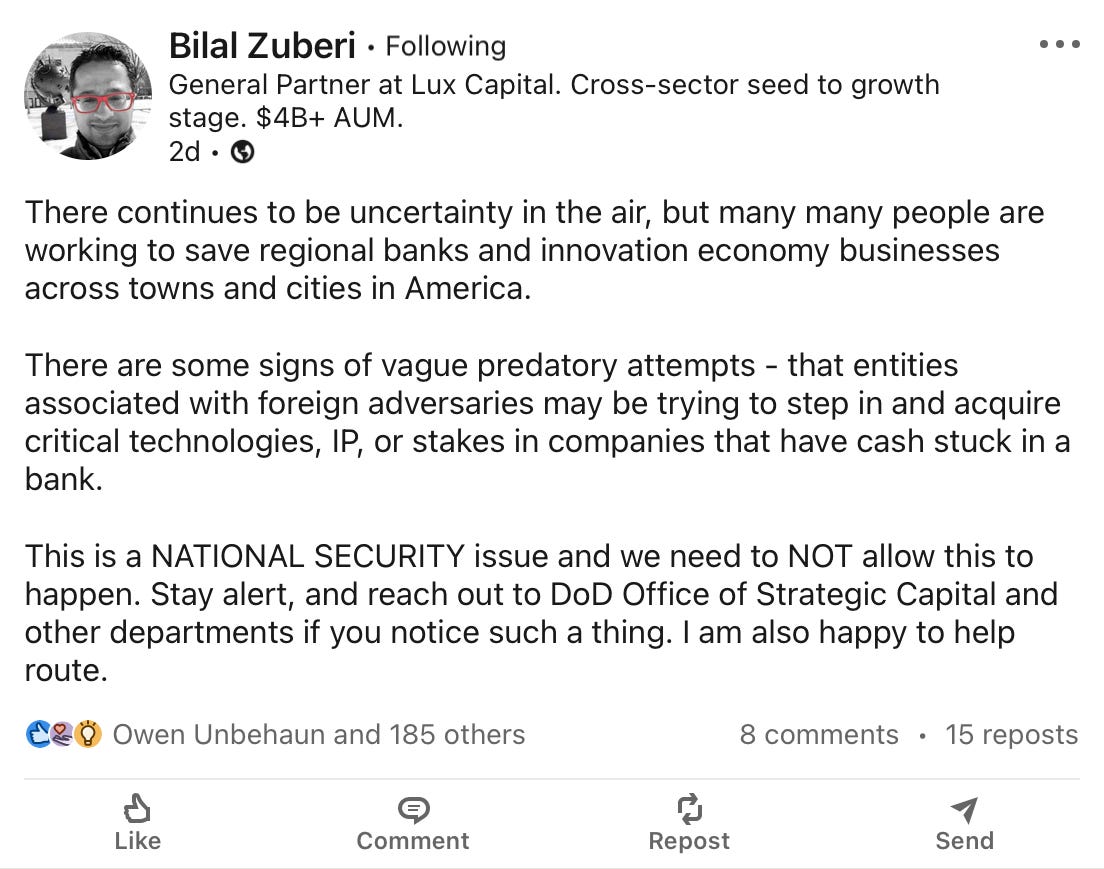

First and foremost, as Bilal Zuberi of Lux Capital highlights, there’s an immediate concern about malign foreign actors trying to take advantage of companies (including defense-focused and dual-use companies) that had deposits in SVB.

Bilal also highlights that there’s a lot of fear and uncertainty about banking with SVB.

This fear and uncertainty has several ripple effects.

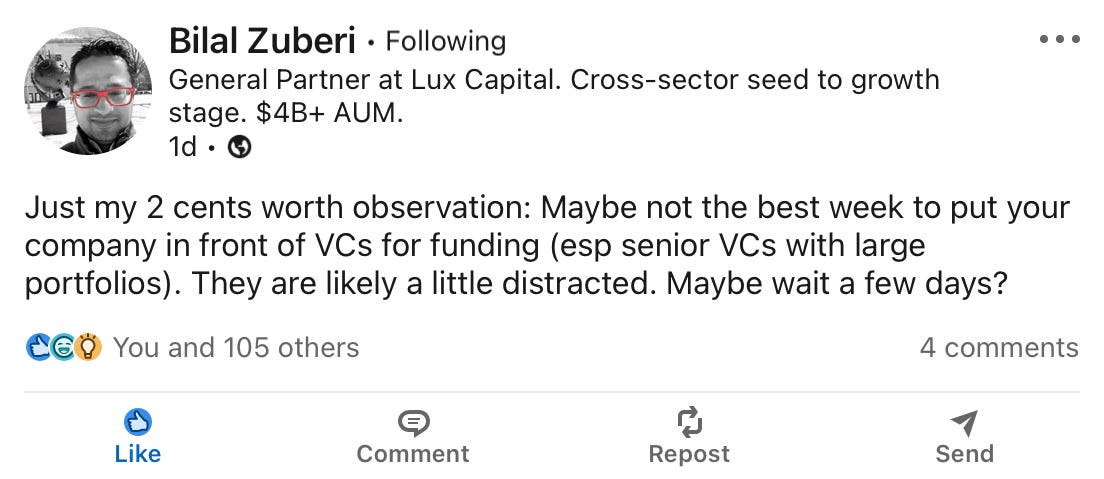

First, for defense and dual-use companies fundraising, expect that VCs are going to be focused on their portfolio companies and SVB. Fundraising will be slow for the next month, I suspect. Again from Bilal Zuberi:

Second, there’s concern about where to park money for lots of companies.

Within 48 hours of SVB failing, Signature Bank also failed, spurring concerns of a contagion spreading to yet more banks.

Fortunately, it appears that the conditions that precipitated these two banks collapse are relatively isolated (even if Credit Suisse finds itself in trouble this week). However, it may make the Federal Reserve re-think the speed with which it raises interest rates to prevent additional inversions.

Still, companies (including defense and dual-use) need to consider where they put their money.

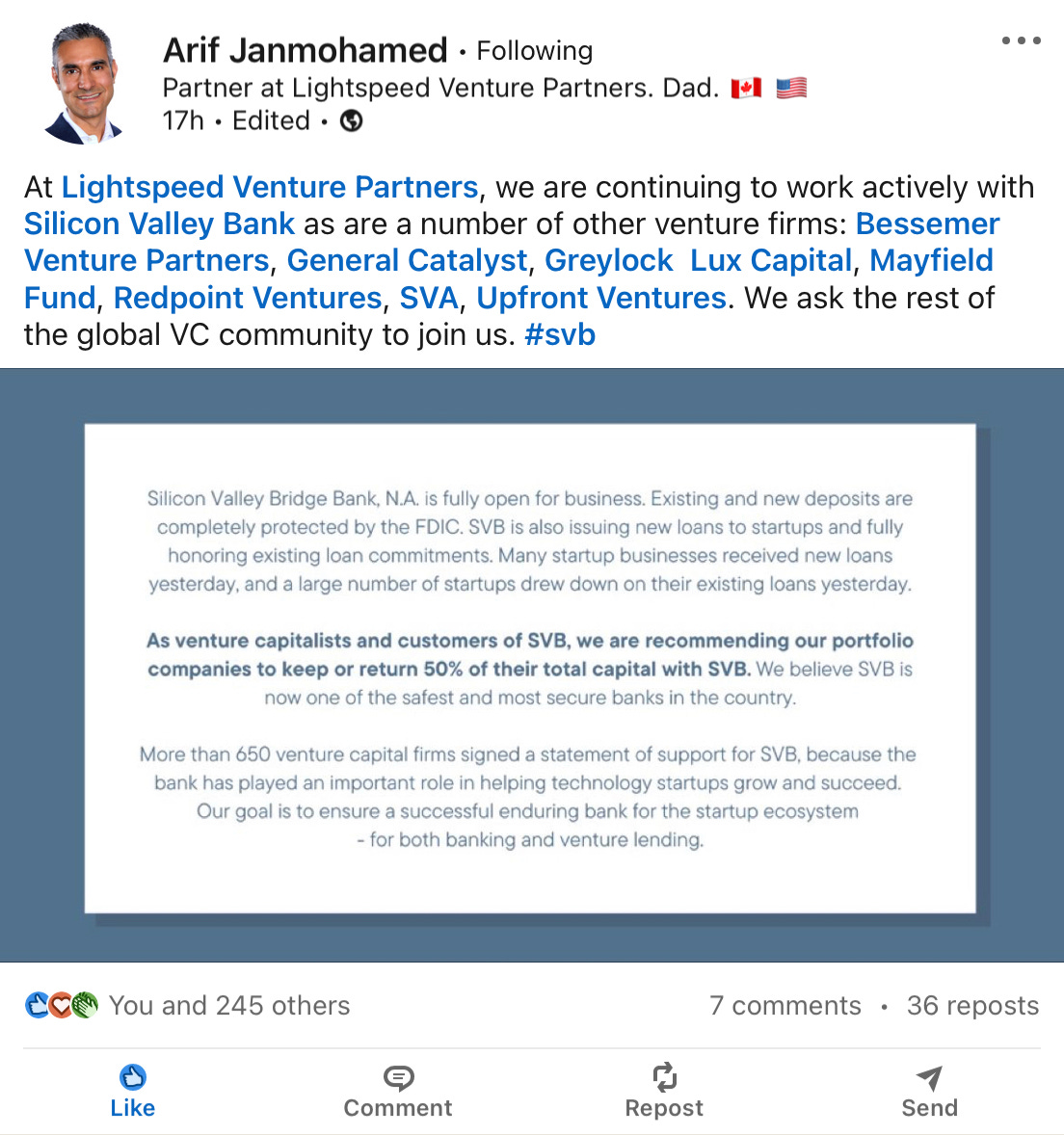

Several VC firms (including Lux Capital, Lightspeed Venture Partners, and several other top-tier firms) have called on their portfolio companies to return their money—at least 50% of it—to SVB. As Lightspeed’s Arif Janmohamed points out, SVB is now one of the safest and most secure options, has new leadership, and has a long history of being supportive to companies.

I fully support Arif’s sentiment. Diversification is fine, and companies must balance the derisking achieved by spreading their money across multiple banks with the increased fees and challenges in accessing funds.

What about longer-term systemic risks? General Catalyst’s Niko Bonatsos highlighted that this event has eroded trust between the federal government and the tech industry which could lead to new regulations that make fundraising more difficult in the long term.

Finally, Colin Beirne of Two Sigma Ventures pointed out that there will be less available Venture debt, driving up demand for venture equity, which in turn will continue to push round valuations downward.

Summary

Much of the impact of SVB’s failure on defense technology companies is consistent with the impact on the larger technology ecosystem, and we can expect the following:

Immediate difficulty in fundraising as VC triage and provide aftercare for their PortCos

That SVB’s failure is not indicative of a broader, systemic problem in the banking system that will result in more, additional bank failures

Defense companies will diversify their deposits (I support Arif and Niko’s recommendations of 50% at SVB, and the remaining 50% split between a top-four bank and another smaller / mid-sized bank)

The federal government may impose additional regulations, further complicating efforts at innovation and fund raising

Longer term, continued downward pressure on round valuations due to increased scarcity of debt

Despite the above expectations, we’ll continue to see the best companies raising funds and we have an imperative to continue building for our defense, security, and welfare.

If you’re building in defense or dual-use, or if you’re investing in companies in the sector, reach out to me directly and let’s schedule a time to talk.

Until then…

Keep Building!

Andrew