Five or six years ago, Defense Tech barely existed. Sure, there were private companies building technology for defense, and some of them even had VC or PE backing. But as an industry, there wasn’t much there.

Today, it’s on fire.

In the past week alone, we’ve seen numerous announcements related to fundraises:

Anduril announced that it’s raising an additional $400-500M, less than a year after its $1.5B Series E

Castelion announced that it has raised $14.2M from a16z and Lavrock to “produce defense hardware”

Saronic announced it’s raised $55M for autonomous seagoing vessels led by Caffeinated Capital, but with participation from numerous heavyweights of the VC industry like a16z, Lightspeed Venture Partners*, 8VC, and Point72 among others

Mach Industries announced a $79M raise at a $335M valuation—four months after its $5.7M seed round (which represented Sequoia’s first foray into defense tech)

GoTenna announced that Lockheed Ventures has invested in the company, for an undisclosed amount / valuation

HCVC raised a $75M fund that it intends to focus on defense technologies

These announcements come only a couple weeks after Helsing announced that it had raised 209M EUR, making it the newest member of the Defense Tech unicorn club, which is pretty much unprecedented for a European Defense company.

As a defense insider, this is all exciting news, but it’s also slightly worrying.

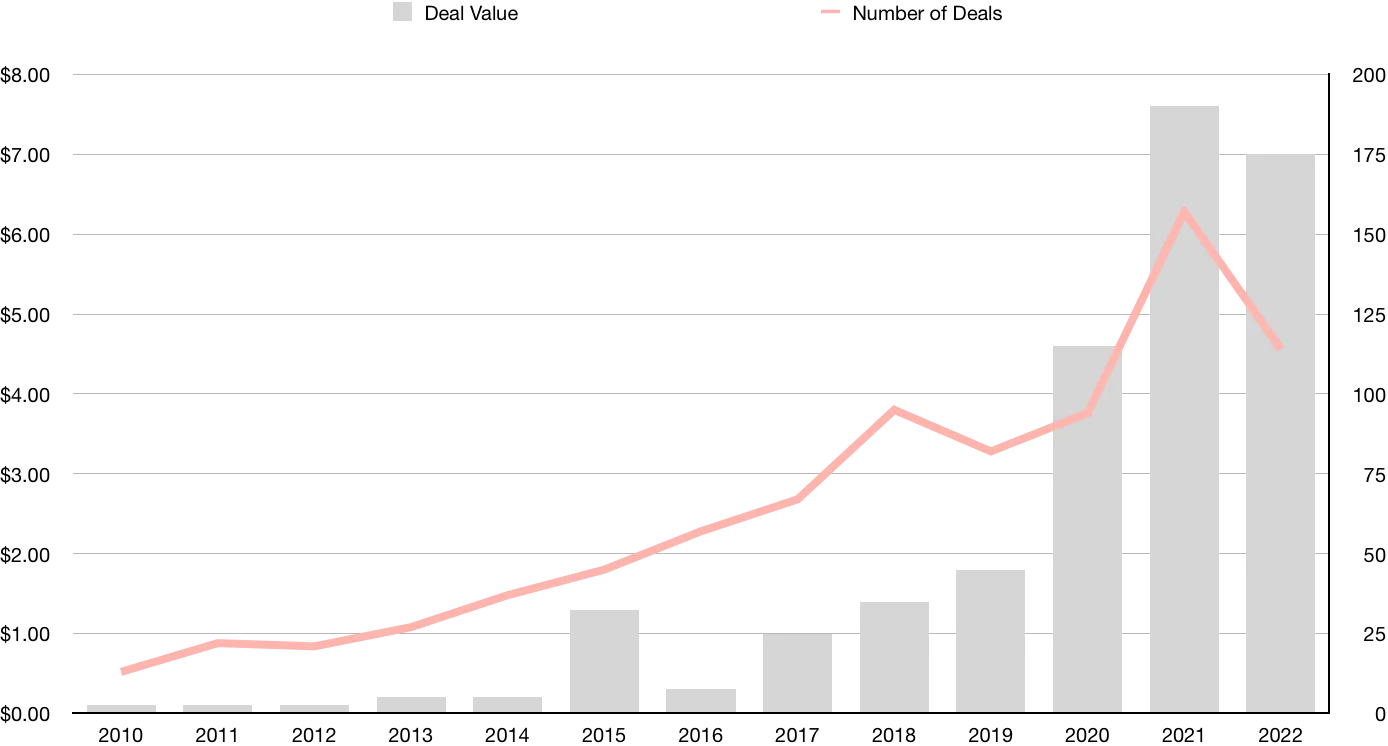

Back in February, I wrote about the exponential rise in defense funding since 2016.

But this week represents something completely different. We’ve seen a shift from defense technology as a niche sub-sector in the VC industry, to it becoming the “it” sector. Or, as Semil Shah, General Partner at Haystack and Venture Partner at Lightspeed said recently in an X post:

AI is the major “tech trend” in the eyes of VCs, while the major “market trend” in their eyes is a shift toward defense, aerospace, and energy.

And this is where we enter dangerous territory. Carey Smith, the founding “contrarian” at Unorthodox Capital has explained how VC is built on bubbles. I’m not suggesting that any of the recent raises are ill-deserved. I wish each company the greatest of success; I know that the DoD needs these products. I do worry, however, that we’re seeing a shift from the deployment of purely “patriotic capital” to the deployment of “momentum capital.”

In an attempt to try to close with some actionable advice:

Founders: remember the basics. Build great products, find product-market fit, control your burn, and solve real problems facing the military and Defense Department.

Investors: remember that while the DoD budget is massive, the department operates on fixed (slow) schedules based on the future years defense program (FYDP). Ensure that what potential investments are working on solve real problems. Use the J-books to assess the realistic size of the market opportunity. Be smart about your due diligence. And reach out to me if you need help or are just starting to consider defense tech as an investible sector.

And of course, don’t let my concern dissuade you. Please,

Keep building!

Andrew

*Disclosure: I served as a defense ventures fellow at Lightspeed

It's like the Reagan years all over again