How to get "Free Money" as a Defense Company

The role of the SBIR program for early-stage defense technology startups

One of the most powerful tools available for early-stage (pre-seed and seed) defense- or government-focused and for dual-use companies is the Small Business Innovation Research (SBIR) program.

Understanding this program could mean the difference between life and death for a start-up.

It can also help investors know how to approach and diligence a potential investment.

What is the SBIR program?

The SBIR program (along with its sister program, the Small Business Technology Transfer or STTR) is a competitive program that encourages domestic small businesses to engage in Federal Research/Research and Development (R/R&D) that has the potential for commercialization.

The program has been in place since 1982 and is coordinated by the Small Business Administration (SBA) in collaboration with 11 federal agencies—including the Department of Defense and the military services.

The program offers funding opportunities to small businesses that meet certain eligibility requirements and demonstrate the ability to conduct high-quality R&D.

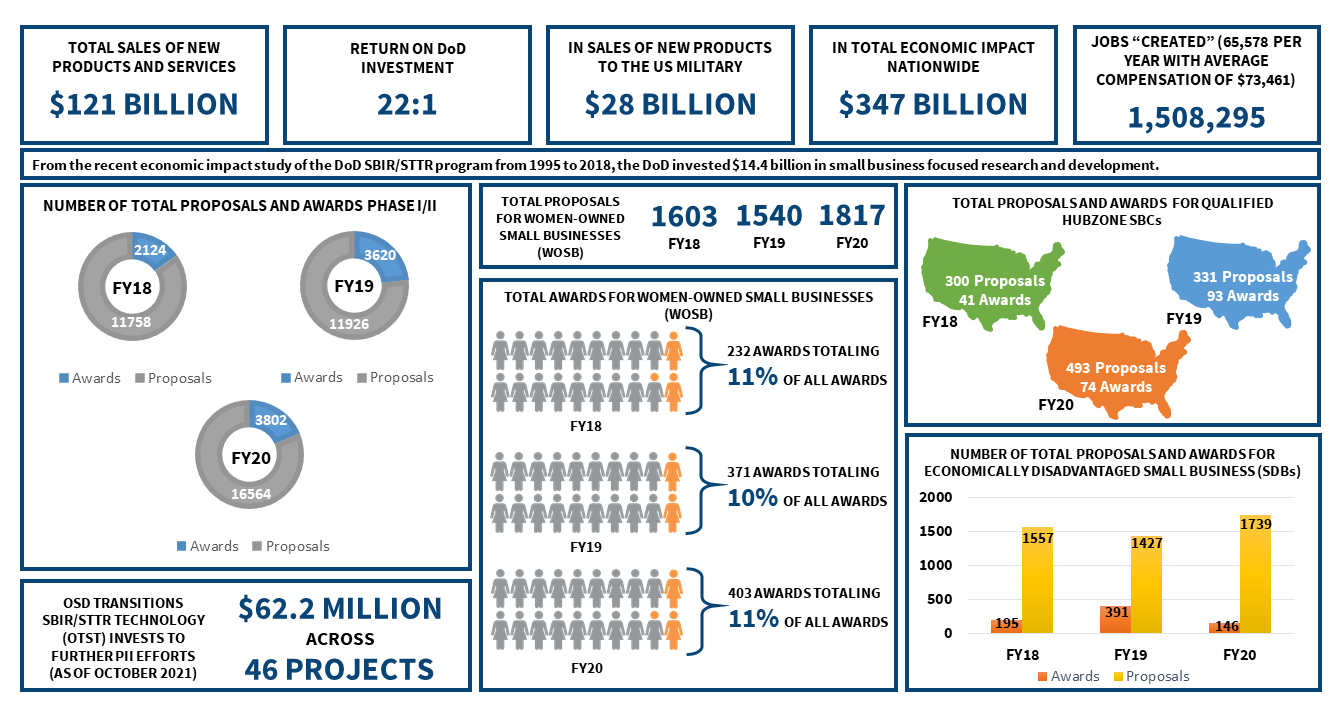

From the DoD’s perspective, the program has been a resounding success with an ROI of 22x, and a nationwide economic impact of $347 Billion!

Why is it good for early-stage companies?

For pre-seed and seed stage companies, the SBIR program provides an opportunity to secure funding that can be used to support research and development efforts.

The program offers three phases of funding, with each phase providing increasing levels of funding for R&D projects.

Phase I funding is typically used to support initial feasibility studies. Phase I awards include up to $250,000 for 6-12 months.

Phase II funding is used to support the development of prototypes and product demonstrations. Phase II awards include up to $1 million for 24 months.

Phase III funding is designed to support commercialization efforts and can be used to secure additional funding from private sources. There is no limit on funding in a Phase III aware; however, Phase III is not actually funded by the SBIR program.

Participating in the SBIR program offers several benefits for pre-seed and seed stage companies.

First, the program provides access to non-dilutive funding, which can help companies avoid giving up equity in exchange for funding. This is particularly important for early-stage companies that are trying to preserve equity as they grow.

Second, the program provides access to technical resources and expertise from federal agencies, which can help companies develop high-quality R&D projects.

Finally, the program provides a pathway to commercialization, as Phase III funding can be used to support the development and commercialization of products and services.

But what about other companies?

SBIR is far less appropriate for later-stage companies for several reasons.

Most importantly, the SBIR doesn’t provide sufficient, recurring revenues to a company on its own to justify later stage valuations.

When an early stage company is prototyping and establishing product-market fit, the SBIR is a useful tool. But at some point, the company needs to develop a go-to-market plan that creates longer-term value.

I suggest that by the time a company has raised a Series A, they need to be moving to capture enduring contracts (this does include the “Phase III”) and begin developing a strategy to capture a program of record in the Future Years Defense Plan.

Series B/C stage companies need to be working to solve top-5 problems for multiple government customers and growth stage companies need multiple programs of record to survive.

Further, as companies grow, they may no longer meet the eligibility requirements; the SBIR program is designed for small business that meet specific eligibility requirements, such as having fewer than 500 employees.

Having said all of that, product diversification can justify a return to SBIRs for later stage companies, but only as a supplemental revenue to other streams.

Where to learn more?

I suggest looking at the following resources for additional information:

U.S. Air Force TACFI / STRATFI Information (this will be covered later too)

In conclusion, the SBIR program is a valuable resource for pre-seed and seed stage companies that are looking to fund their R&D efforts. The program provides non-dilutive funding, access to technical resources, and a pathway to commercialization.

If you’re a company trying to navigate the DoD or if you’re a VC investing in defense tech companies, make sure you subscribe to stay up to date and…

Keep building!

Andrew