This post is a dense one. If you want the take-aways without reading the numbers, skip to the Implications for A&D Tech Companies and Investors section…

2021 was aberrant. Aberrant and wild.

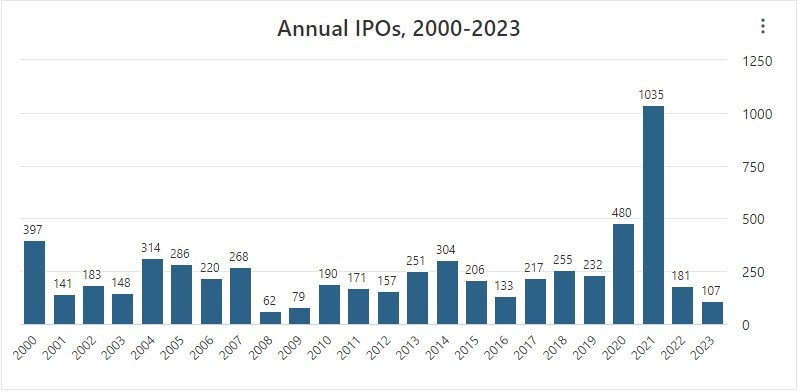

There were roughly 1,000 initial public offerings (IPOs) that year. The year prior there were fewer than 500. The year before that, there were fewer than 250.

In essence, an IPO marks the transition from a privately held entity to a publicly traded one. During an IPO, a company offers shares of its stock to the general public for the first time, allowing outside investors to buy ownership stakes in the company. This process typically involves intricate regulatory and financial procedures to ensure transparency and compliance with securities laws. IPOs provide companies with access to a broader pool of capital, enabling them to fund ambitious projects, expand operations, and drive innovation in the fiercely competitive aerospace and defense industry.

Significant changes in the number of IPOs is an important indicator used to understand the broader private and public market conditions.

So, 100% annual growth is massive. So is the 80% contraction that occurred in 2022 (most of the IPOs that did happen in 2022 were in the first quarter). We entered an IPO-drought.

The euphoria of 2021 was clearly over. But the fact that IPOs dried up nearly completely is remarkable and telling of the uncertainty, fear, and overall hangover in the markets.

So, here we are about to enter the final quarter of 2023, and finally we’re seeing some signs of recovery in IPO trends—hopefully indicating a sense of health in the private markets and optimism for the public markets.

The SEC has received IPO filings from two notable companies, Instacart and Arm Holdings.

There’s a hope shared by some across the venture and tech landscapes that these two IPOs could pave the way for many more to follow. Regardless, I think understanding these two companies and a bit about their IPOs can provide a lot of information for the broader Aerospace & Defense technology ecosystem.

Instacart

First, let’s look at Instacart. It’s an eleven year-old company that operates a grocery delivery and pick-up service across North America. The company has raised nearly $3B over its life, including a $265M round in March of 2021 at a $39B valuation.

That year, that aberrant year, was clearly very good for Instacart. Pandemic lock-downs and fear over COVID, drove mass use of delivery companies like Instacart.

Now, Instacart has filed paperwork with an initial, targeted price range for its IPO, between $26 and $28 per share. It’s offering 22,000,000 shares at those prices, which would raise $367M-$395M (only 14,100,000 of the shares come from the company, the rest from existing shareholders). Renaissance Capital has run the numbers and found that at this price range, Instacart will have a fully diluted market value of around $8.9B—a 77% lower valuation than the company had in the private market two years ago.

Notably, Instacart had annual revenues (ending June 2023) of $2.9B. So an $8.9B valuation represents a 3x multiple. According to TechCrunch, in 2021, Instacart had revenues of $1.83B. We can estimate that it was then valued at a 21x multiple.

The 3x multiple seems a realistic and fair one to me, looking at companies such as Uber and DoorDash that have enterprise values around 3-4x their revenues.

Arm Holdings

Arm Holdings is a multinational semicondutor company that designs, produces, and licenses IP for digital electronics product development. SoftBank—yes, THAT SoftBank—bought Arm Holdings in 2016 for $32B.

SoftBank tried to sell Arm for $40B in 2021 to Nvidia, but the deal fell through due to regulatory concerns. When that deal fell apart, SoftBank decided to pursue an IPO.

In its F-1 filing (essentially an S-1 for a foreign based company), Arm set its price range at $47-$51 per share, but has since said it will only accept the top of that or higher, based on investor commitments. As such, it seems likely that it will achieve a $54.5B fully-diluted valuation, raising around $5B in the IPO.

Again, in its filing, Arm disclosed that its annual revenues for the period ending March 2023 were $2.7B, flat compared to the year prior, and up from $2.0B in 2021. Using the $54.5B valuation and flat revenues, it will be valued at 20x its revenues.

My initial reaction at seeing this multiple was something akin to:

I thought, hey! Here we have a hardware company with a 20x multiple and a software company (Instacart) is at a 3x multiple. BUT, that’s not the case. Go back to when I describe Arm’s business. It makes its money by designing and licensing chips, not making them.

Still, it’s a noteworthy valuation, as it highlights the criticality of advanced chip design. Their business is similar to Nvidia’s. I learned this morning that Nvidia outsources their fabrication to TSMC, and Nvidia itself only designs and sells the chips. So we can take two clean lessons from here:

Hardware companies are still not trading at software-like multiples. The actual chip manufacturers like TSMC trade at single digit multiples (TSMC’s current EV over it’s 2022 REV is ~6x).

Hype has a real impact on valuations still. Nvidia is well known for its designed graphics-processing units (GPUs), which are actually fabricated by TSMC. Nvidia has an EV/REV of ~30x. This multiple is largely driven by hype around AI and the large language models which use GPUs. Qualcomm, which also designs GPUs, with near comparable performance to Nvidia’s is lesser known and discussed. In other words, there’s less hype. So, Qualcomm is trading at ~3.5x. And, sell-side analysts agree that Nvidia is overvalued while Qualcomm is undervalued. Arm’s chips are used in smart phones, and there is a lot of hype about the company—in part due to the failed Nvidia acquisition.

Implications for A&D

As promised, I want to try to extrapolate from these two IPO filings to inform the discussion around aerospace and defense.

Valuations

I think the first lesson is that public comparables remain an important tool for establishing realistic valuations of companies; however, this isn’t an exact science for startups where there exists expectations to grow revenues over time using the capital invested.

Aerospace & Defense companies tend to trade at single digit multiples. This is driven in part by the reality that most A&D companies are hardware-first companies. While we may factor in future revenues, investors must be cautious about overly-inflated valuations. This is even true for software-first A&D companies or those operating inside of ‘hype’ areas like AI.

Mindset

Next, I think it’s important for A&D companies to remember the words of Lou Holtz, the famous college football coach and commentator:

You’re never as good as everyone tells you when you win, and you’re never as bad as they say when you lose.

Taking an 80% haircut on valuations—as Instacart did—is undoubtedly humbling. Hopefully, they didn’t believe the hype at $39B and they’re not feeling overly down at $8.9B (which, holy cow, still amazing!).

Similarly, it’s important not to accept too much hype around a sector. AI is the rage right now. Two years ago, it was crypto.

Founders, operators, and investors all must develop almost Zen-like mindsets, that allow them to remain detached from fluctuations in certain metrics, especially valuations.

Timing

It’s important for companies to strike while the iron is hot. Instacart likely would have raised significantly more had it IPO’d in late 2021 than it will now. Of course, as a public company, it would have seen a marked drop in its market cap, but that’s not atypical. Still, private A&D companies must consider the timing of going public to 1/ capitalize on a strong economy and positive sentiment and 2/ avoid potentially significant devaluation and possibly delisting (as Astra, Momentus, Spire, and others all have struggled to avoid this year).

The reality is that we’re in a good period for aerospace and defense. I don’t think that will end for a few years, but we never know for sure.

It’s great that we’re seeing positive signs of recovery from the bearish conditions that led to an IPO drought. We need to be somewhere between the euphoria of 2021 and the hangover of 2022/2023. It looks like 2024 will strike some of that common ground. Take the opportunity to learn from other companies, important lessons for the sector that we’re working and investing in.

And above all, please,

Keep building!

Andrew