This is part of a series on the role of private capital in supporting defense. Select previous editions include:

If you haven’t already, I suggest you go back and read some of those too.

Building for defense takes a long time. That’s because the Department of Defense is a large, slow bureaucracy and bureaucracies are never fast.

Or as Laurence Peter said:

Bureaucracy defends the status quo long after the time that the quo has lost its status.

Fleas and Elephants

With the DoD being so large and bureaucratic, there’s a significant mismatch between the processes and timelines, on which the Department operates and those on which startups operate.

The Department of Defense may take several years to conduct critical needs analyses, identify gaps, define requirements, and even begin to look at material solutions.

In that time, a startup could form, create its minimal viable product, raise capital, and be acquired or wind-down operations several times over. In fact, here’s a list of the fastest $1B+ exits (Oculus took only 280 days from first financing round to exit).

The slow and ponderous way that the Defense Department moves has historically not been an issue.

Historically, the Department conducted most of the meaningful R&D on its own and could do so at its own leisure.

With the consolidation of the defense industry that accelerated at the end of the Cold War, the Defense Primes were large enough that they moved at speeds similar to those of the Department of Defense.

As Peter Drucker said:

Large organizations cannot be versatile. A large organization is effective through its mass rather than through its agility. Fleas can jump many times their own height, but not an elephant.

Startups are fleas and rely on speed and agility. Defense Primes are elephants, reliant on mass and momentum to carry them through.

Lessons from the Auto Industry

Several months ago, I presented a side-by-side comparison of the defense and auto industries to partners at a prestigious venture capital firm.

One of the partners took me to task, feeling that the auto industry wasn’t a perfect analogue to the defense industry. Of course it isn’t. No analogue is perfect, they just provide heuristics for us to garner lessons.

Twenty years ago, the auto industry looked very similar to how the Defense industry looks today: deeply entrenched, legacy companies dominated the industry and little innovation happened.

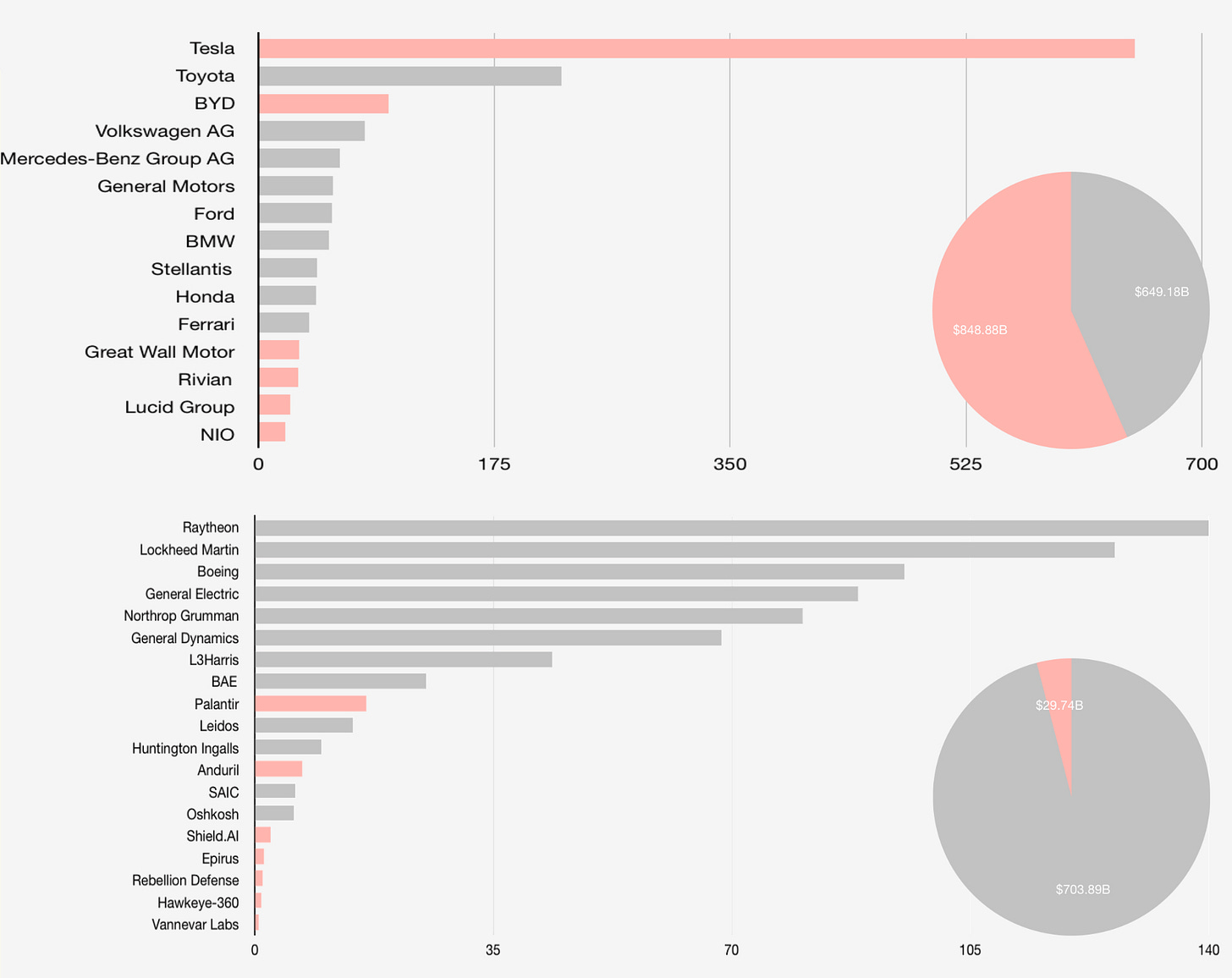

Then along came Tesla, an electric vehicle startup that limped along for six years before reaching a sizeable valuation of $500M. As Tesla was growing, another company thought it could do something similar and Lucid was born. Lucid took 11 years to reach a similar valuation. Rivian took 10 years.

And then, something magical happened: the time it took for disruptive auto companies to scale and have an impact on the industry contracted from a decade to 3-5 years.

Some of these companies have risen and fallen, as happens; but, today, these disruptive companies now control a significant portion of the auto industry’s market capitalization.

As I discussed last week, the Defense industry is very much dominated today by the legacy companies. At the same time, the disrupters have made in-roads into the market and these market caps may look very different in a few years—closer to those of the Auto industry.

A Defense Tech startup faces the same lead-times to growth as in the auto industry. Palantir took seven years to reach a $500M valuation. Hawkeye 360 and Shield.AI took six years each. We’re seeing a bit of an acceleration, as Anduril, Epirus, Rebellion Defense, and Vannevar Labs have all reached that valuation in less than 3 years.

Nevertheless, the expectation for a Defense Tech startup should be that it will need to limp along for half a decade or longer, proving its ability to not only disrupt but also to capture enduring contracts from the government (in the form of programs of records in the FYDP or Future Years Defense Plan) before it can expect real traction.

Venture Capitalists similarly need to understand that a startup working in Defense will likely need support longer than an enterprise SaaS or FinTech company. If you’re building a Defense investment program, that expectation needs to be communicated internally to all of the partners and externally to the LPs.

In future editions of the newsletter, we’ll dig in to how startups can capture non-dilutive capital and business at the early stages while building relationships with key partners to capture longer term and enduring business.

Until then, drop a comment and let me know if the VC partner was right that the Auto Industry isn’t useful for understanding anything in Defense or if you think I was right. And as always…

Keep Building!

Andrew

One can argue that a key difference between legacy automotive and defense industries is primes' advantage of built-in moats via programmed/expected sustainment. Some of Tesla's allure is how they capture revenue beyond initial sale - software and feature upgrades, insurance, etc. Similarly, when GDLS sells a Stryker...they know they're in a good position to win future modification and upgrade contracts. When Ford sells an F150 off the lot, it's effectively a one-and-done transaction.

How else can we de-risk investment to make hardware margins palatable to startups/investors? A true acquisition magic trick would be to optimize outcomes for the warfighter, costs for the FYDP, jobs for the legislators, all while protecting new entrants's ability to attract capital and talent.