Last week, I presented a list of significant American technological innovations.

These innovations demonstrate America’s ability to lead innovation that extends beyond social media apps; they demonstrate our ability to lead innovation that makes meaningful improvements in our lives and in the world.

Interestingly, technological innovation in the second half of the 20th century was largely dominated by government R&D efforts.

Today, this is no longer the case.

So, who has taken on this responsibility and how are they funding these long-lead efforts?

The government’s legacy is private industry’s future

The 20th century was dominated by interstate conflict. Never before had war grown to such massive scales and governments funded efforts to be more efficient in killing and destroying enemies.

While wars before the 20th century certainly saw massive death tolls (Napoleon’s campaigns led to several million deaths), the casualty rates in the 20th century remained unprecedented. The First World War saw upwards of 40 million deaths. The Second World War saw 80 million deaths.

After the Second World War, the United States and the Soviet Union locked into the Cold War. Fearing wars on the scales of the Second World War, the governments of these two countries invested heavily into technological innovations that could be use to gain advantage. Many of those technologies have made their way into society and become commonplace.

What’s more is that the role that the government played in advancing those technologies has largely been taken over by private industry.

Some examples:

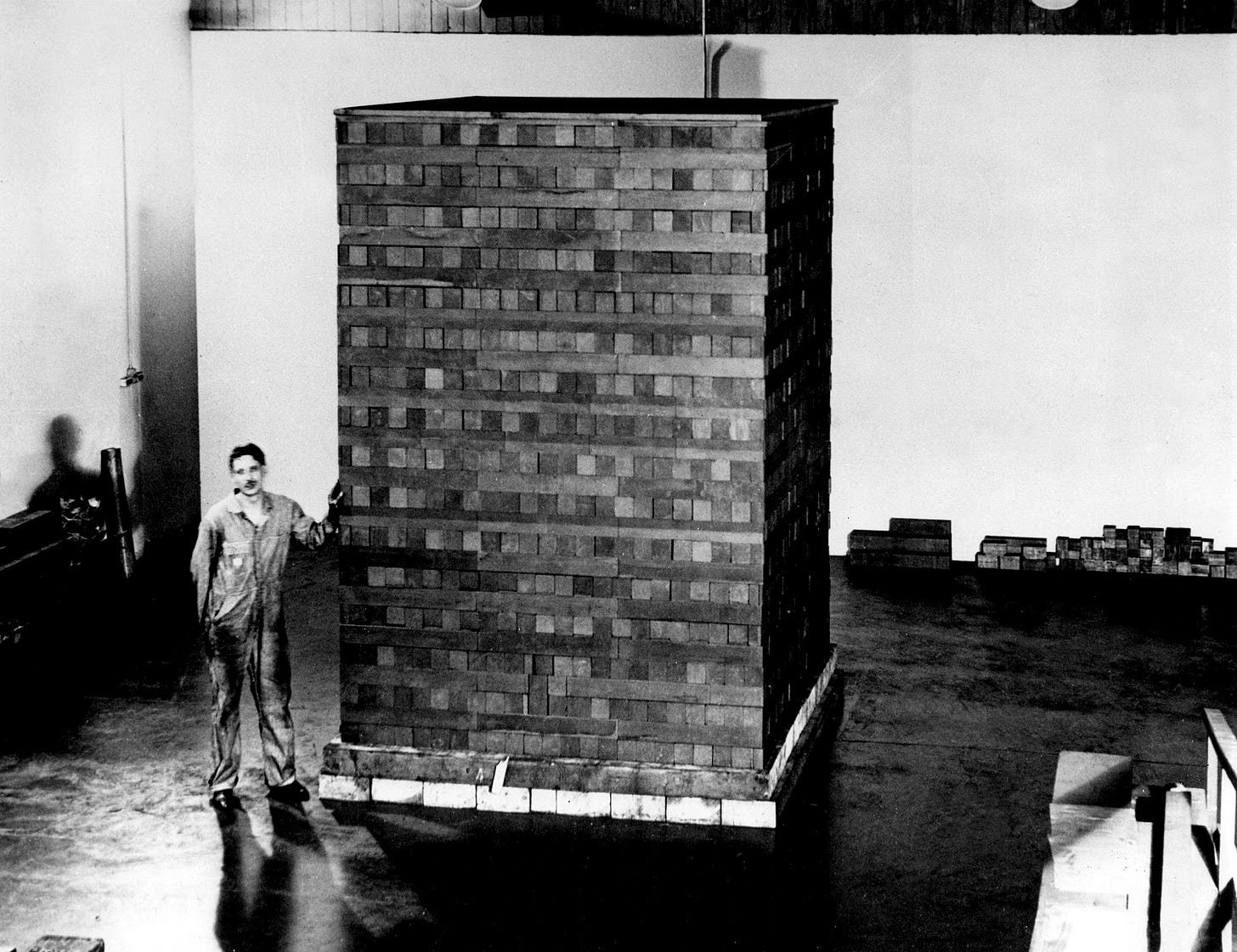

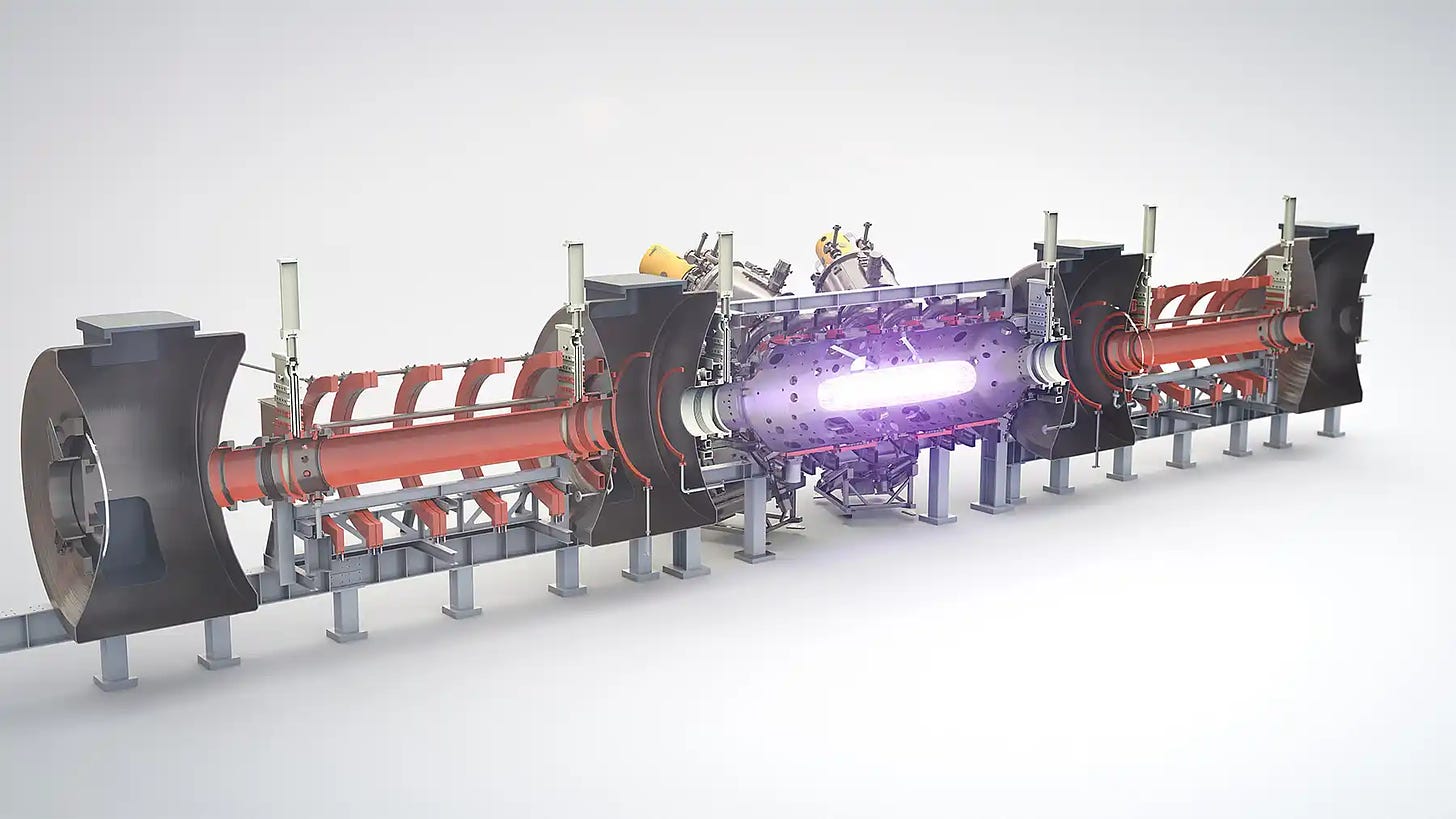

The U.S. Army funded the Manhattan Project and it’s Chicago Pile-1, which resulted in the first sustained nuclear reaction, ultimately giving us nuclear energy. Today, numerous private companies are building experimental fusion reactors—like TAE’s Copernicus reactor—advancing the state of the art even faster than the Department of Energy.

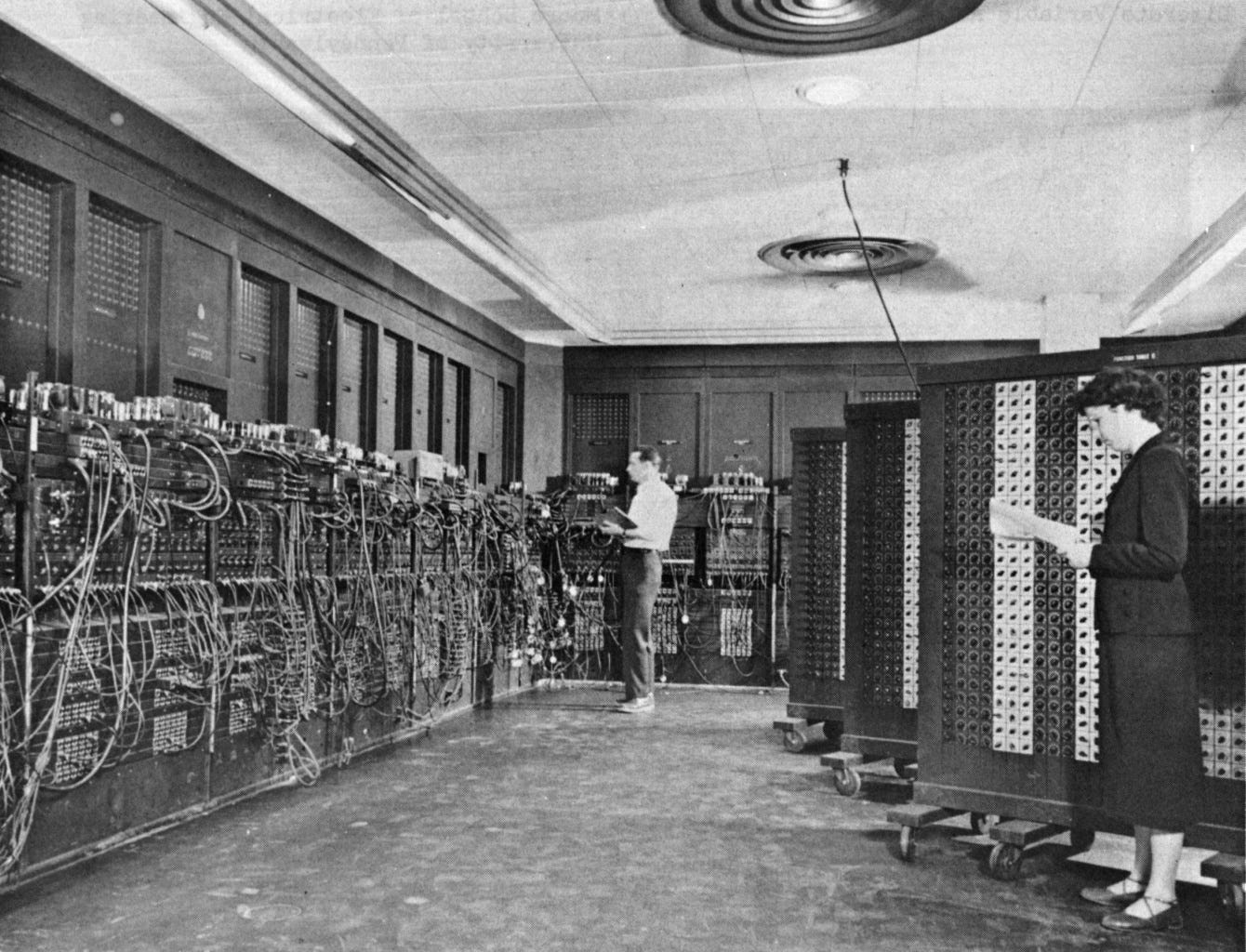

The U.S. Army funded the Electronic Numerical Integrator and Computer (ENIAC) during World War II. ENIAC was the first programmable, electronic, digital computer, used primarily to calculate artillery firing tables. Today’s supercomputers, like Hewlett Packard’s Frontier Supercomputer, are built and advanced by private companies like Hewlett Packard, IBM, Fujitsu, Atos, and Nvidia.

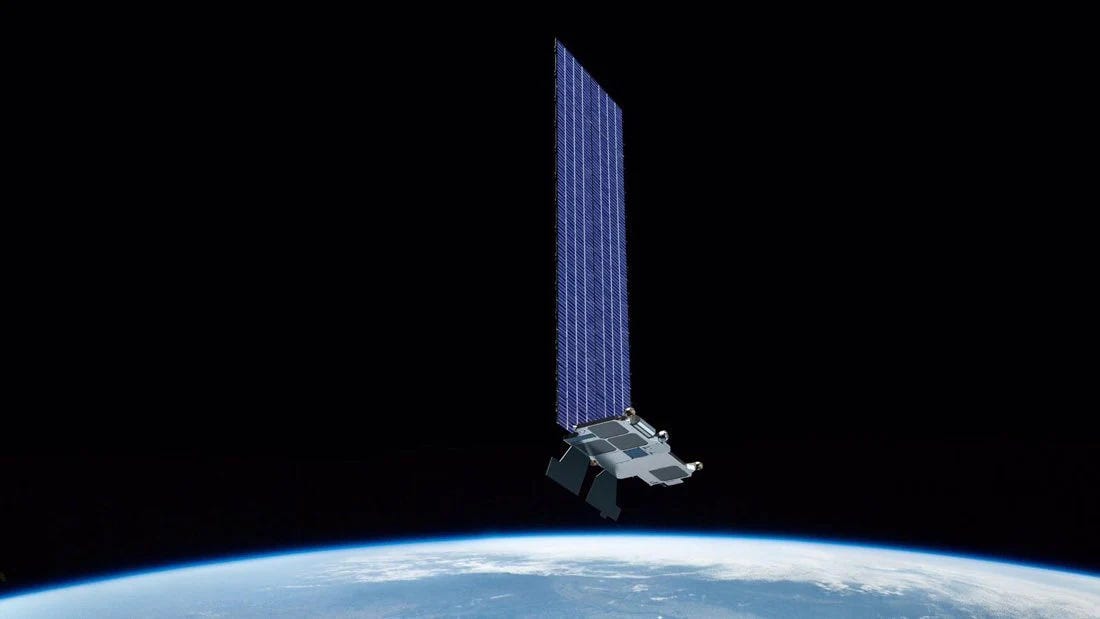

The U.S. Navy built the Navy Navigation Satellite System or NAVSAT during the second half of the 20th century. NAVSAT was the progenitor of today’s GPS systems, which keep most drivers, hikers, and delivery bikers from getting lost. Now, even today’s GPS could be rendered obsolete by advancements from the private sector like SpaceX’s Starlink satellites, which could work similarly.

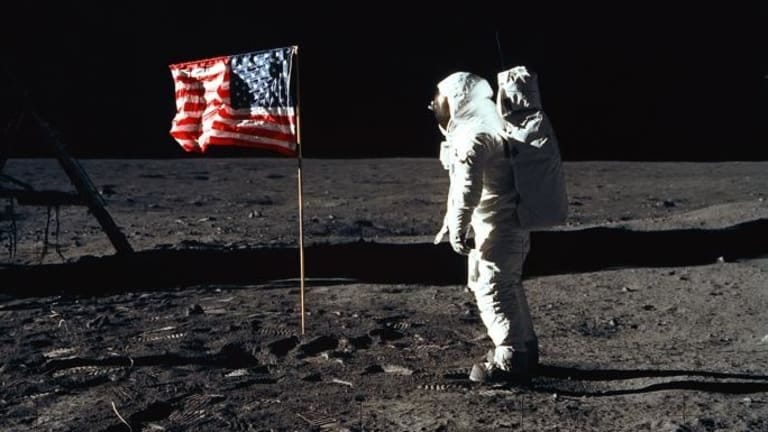

The Cold War led to the massive advancements in rocket technology (from Nazi Germany’s V2 rocket to far more advanced ICBMs and ultimately to space launch vehicles). In 1969, NASA’s Apollo program succeeded in the first manned lunar landing. The U.S. government spent a total of $25.8 billion on the Apollo program ($257 billion in today’s dollars). Private industry is now accelerating space launch and exploration, with companies like SpaceX, RocketLab, Astra, United Launch Alliance, and others.

The U.S. Department of Defense built the first intra- and internets starting in 1969 with ARPANet. This revolutionary technology allowed the government to synchronize warning and missile response systems. Today’s internet technologies, such as cloud computing, are advanced by private companies like Amazon’s Web Services.

The role that government played during the second half of the 20th century in advancing technology has been subsumed largely by private industry. There remain critical advancements but it is often no longer obscure government agencies or offices building in secret.

Defense Technology and Venture Capital

As private industry takes on the role previously played by government in researching, developing, and building advanced technologies, funding similarly needs to shift towards private capital sources.

That’s not to say that government will play no role in funding these technologies. They will, and it will be an important role. Government and defense department as customers necessarily must contribute capital to procure these systems that private industry is advancing.

At the same time, private capital will play a growing role in funding the companies early in their lives. This is because private capital is efficient and many of these technologies may be “dual-use” with practical applications both in defense/government and in civilian use-cases.

Fortunately, we’ve seen venture capital firms and other sources of private capital increasingly willing to take on this responsibility.

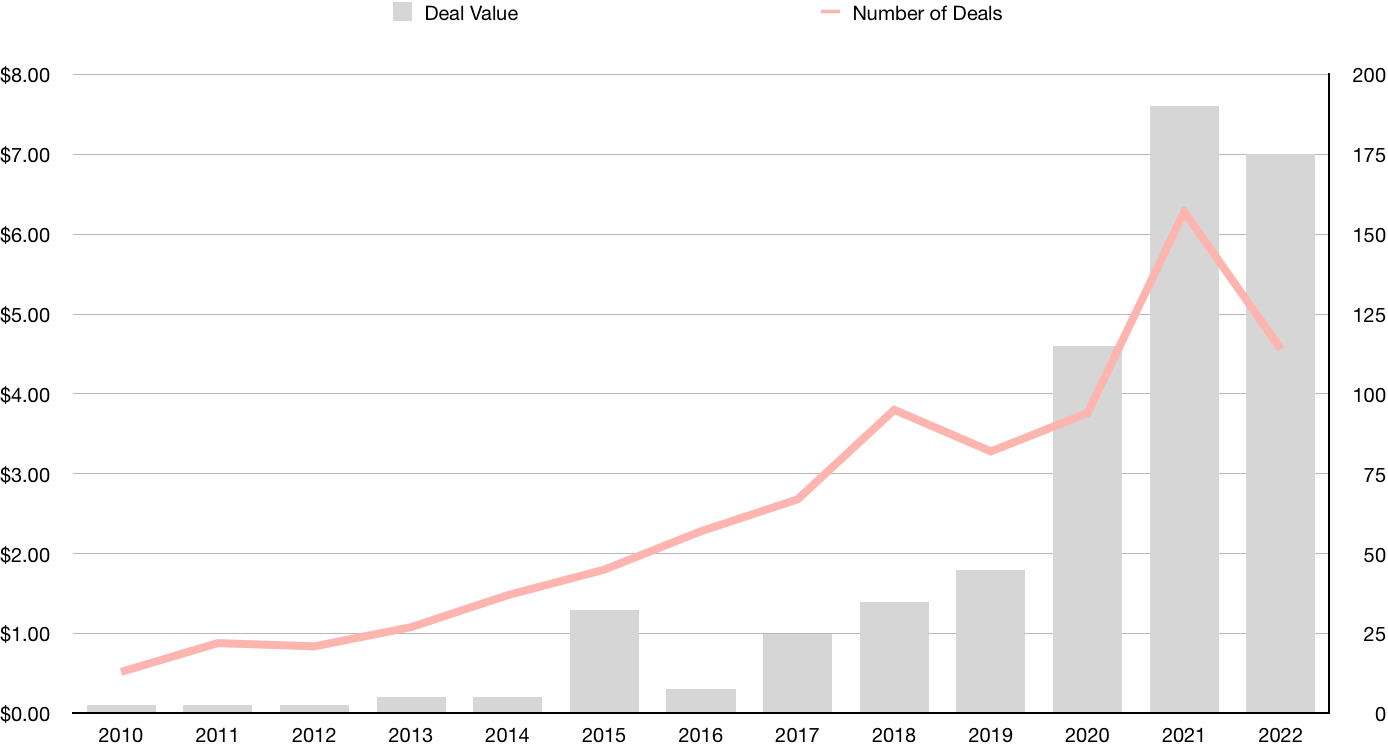

Venture Capital commitments to Defense Technology have risen dramatically over the past decade from around $100M in 2020 to around $8B (and likely more) today.

This is leading to a proliferation of novel companies, technologies, and solutions for defense requirements: such as Anduril’s Lattice OS enabling unmanned systems, Red-6 developing augmented reality training systems for training pilots, Vannevar Labs improving intelligence and disinformation efforts, Shield AI building autonomous aircraft to enhance the Air Force’s combat power, Hawkeye 360 enabling intelligence and earth observation efforts.

I expect that these investments will continue to climb and more companies will see that supporting our national defense is a worthy and honorable cause.

So, who’s investing?

The list of firms that are increasing investments into defense technology and other areas of hard tech continues to grow each day.

Some of the largest and most prestigious firms are championing this cause: Andreessen Horowitz (a16z), Founder Fund, Insight Partners, Lightspeed Venture Partners, and Lux have all contributed to defense tech investments recently.

By no means are these firms alone. Many others have invested in defense—perhaps even longer or more substantially as a percentage of their fund. These include:

Dcode (through their Dcode Capital arm)

New entrants emerge regularly. Over the past few weeks, I’ve seen several individuals and firms post “market maps” of defense tech companies indicating research for possible investments. (As a side note, I built a similar market map in 2022 for Lightspeed, which I’ll share soon—I just need to review and update it).

Further, even larger public companies are seeing the opportunity and need for capital investments into these companies. Many have created Corporate Venture Capital (CVC) arms to expand their investments: including Lockheed Martin, Raytheon, Booz Allen Hamilton, and others.

If you’re a venture capital firm that is considering national security, defense, hard tech, or other contributions to advancing the global good, now is the time to do so!

Reach out to me and I will help guide you through establishing your defense technology investment program.

If you’re a founder wondering if there’s money to support you as you target solving the greatest challenges facing our society, take reassurance that there is!

Reach out to me and I will help you understand how to navigate venture capital and government sales.

And of course…

Keep building!

Andrew