There’s a massive shift coming in defense contracting.

Industry giants like Lockheed Martin, RTX, Northrop Grumman, Boeing, General Dynamics are growing increasingly reluctant to participate in the most traditional contracting method—the method that most reduced risk to the government. This wariness stems from several high-profile cases of cost overruns, forcing companies to absorb billions in losses.

Growing Reluctance

During its quarterly earnings call, Lockheed Martin’s CEO Jim Taiclet announced that his company would push back on what her perceived as the DoD’s monopsony power. Lockheed Martin will no longer consider any fixed-price contracts to be a “must-win program.”

Taiclet’s announcement echoes one from L3Harris CEO, Chris Kubasik, last summer. Kubasik announced that it would draw a hardline on fixed-price contracts that it felt was the wrong vehicle for certain contracts, viewing them as creating too much risk for the company.

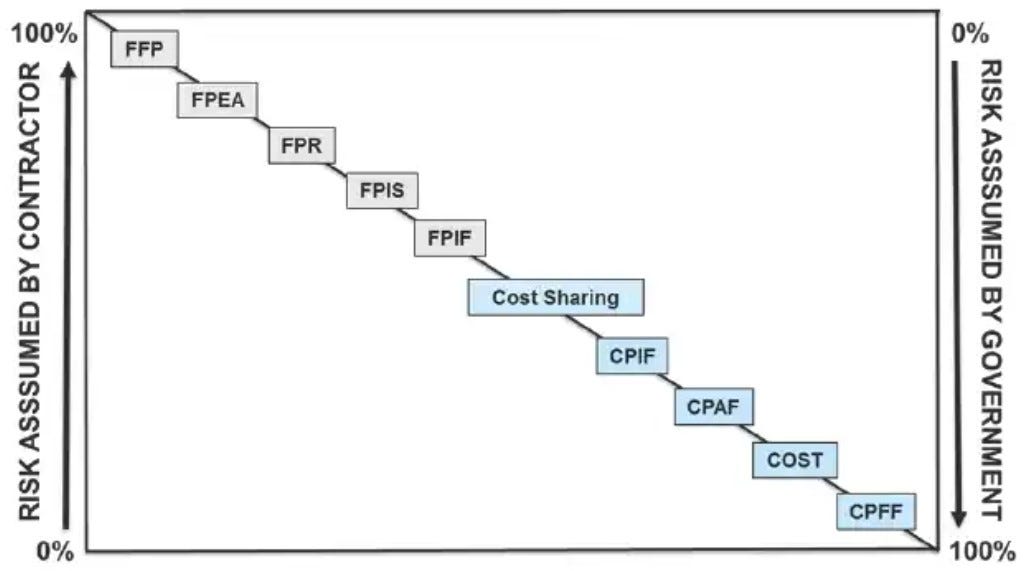

And there is risk. Under a fixed-price contract, the contractor has the obligation to deliver a system as defined in the contract for the price specified in the contract. If the contractor poorly estimates the cost of the product, or if there are unforeseen overruns, the company eats that cost.

Two recent examples:

Boeing won a deal to build KC-46 refueling aircraft on a fixed-price contract. This program has suffered massive cost and time overruns. Thirteen years into the program, Boeing has been forced to shoulder $7Bn in overruns.

Northrop won a fixed-price contract to build and produce the new B-21 bomber. The company seems to have underbid the contract, and now will eat $1.2Bn on the program.

Primes’ Preference

Taiclet and Kubasik would likely rather see the government use more “cost-plus” contract vehicles that allows the contractor to shift risk back to the government.

Of course, this can lead to disastrous burden on the Department and American taxpayers. For example, earlier this month, the Department of the Air Force notified congress of a ‘critical’ breach of the Nunn-McCurdy act concerning the Northrop Grumman built LGM-35 Sentinel ICBM. Any price increase of a system greater than 30% is considered to be a critical breach. The missile program went up by 37% or $29.7Bn.

It’s understandable then that Northrop would not want to shoulder that cost, but it’s also not fair for them to push that cost to the government. Yet, that is exactly what we expect to happen, as we anticipate Secretary of Defense Austin to certify that the program must continue.

While many overruns are legitimate changes driven by changed customer requirements, disruptions to supply chain, or other unexpected costs, there’s also more than a bit of fraud, waste, and abuse that the government pays for under cost-plus contracts. A May 2023 investigation by 60 Minutes found that these same defense contractors were price gouging--inflating prices to increase profit margins from 12-15% up to 40%.

Two months later, Booz Allen Hamilton agreed to pay more than $377M to settle allegations that it had defrauded the government, charging millions on contracts improperly.

Market Dynamics in Defense Contracting

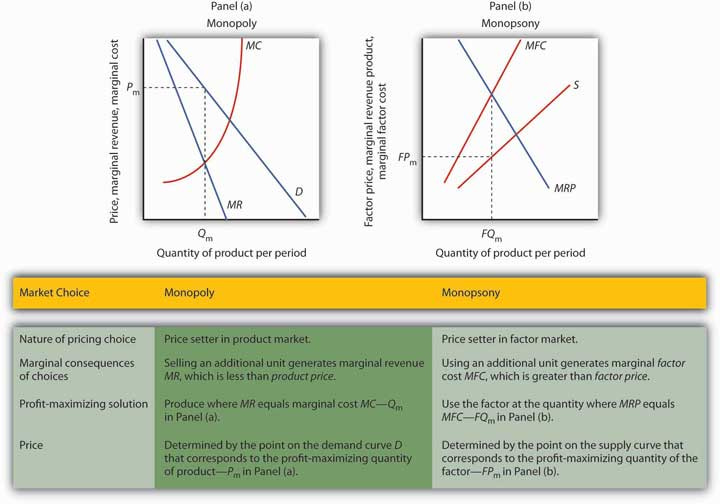

An NPR segment this week discussed how the department's monopsony power, coupled with the contractors' monopoly power, has created an inefficient dynamic. The Department of Defense's monopsony power, where it is the sole buyer of goods and services, meets the contractors' monopoly power, where a few companies dominate the market. This has led to a 'bilateral monopoly'—a unique situation where both monopoly and monopsony powers coexist.

In such a bilateral monopoly, inherent inefficiencies emerge. The reduced competition, a consequence of government-sanctioned M&A activities post-Cold War, allows defense contractors to wield significant pricing power. At the same time, the largest defense contractors view the government as the only potential buyer (despite there being an international defense market). This creates a friction that relies heavily on bargaining power and skills. The government, for its part, usually struggles to negotiate favorable terms due to the limited pool of contractors. This imbalance leads to inflated prices and, ultimately, an inefficient allocation of resources.

Opportunity for Startups

This industry shift presents a unique opportunity for startups to step into the void created by the primes’ hesitation. With cash runways from investors, startups can underwrite the risk associated with fixed-price contracts and introduce innovation and agility into defense contracting. This infusion of fresh ideas can reshape the market dynamics and challenge the status quo.

I’ve previously discussed how public companies can outsource their R&D to startups, creating symbiotic relationships. This opportunity is very similar. Startups have greater flexibility and need to create compelling products for the Department. While I’ve previously hinted at a growing pessimism about the opportunity for non-acquisition exits for startups, it is possible that this refusal of the primes to engage on government-friendly contracts will allow several startups to come in and shake up the ecosystem to such an extent that several of them can grow true competition for the largest firms.

Rethinking Contract Models

To successfully disrupt the ecosystem, startups need to capitalize on the opportunity presented by the largest firms unwillingness to participate in contract models that buy-down risk for the government. This can be accomplished through bidding on the fixed-price contracts or through the creation of alternative models.

Shyam Sankar, CTO of Palantir, has proposed just such an alternative model. Sankar's advocates for moving away from the services-based approach captured in both cost-plus and fixed-price contracts towards a product-based approach that more closely resembles traditional Software-as-a-Service (SaaS) models. Doing so incentivizes industry R&D efforts, increases competition, and creates a more efficient defense market. This results from any given company having to create and sell a product that is so compelling that the DoD would be willing to abandon conventional services-based contracts.

Charting a Course Forward

As we navigate these shifts, it’s evident that the defense contracting landscape is ripe for innovation and efficiency. Startups, with their agility and inventive approaches, have a unique role to play in reshaping the narrative. Simultaneously, alternative contract models, like Sankar’s product-based suggestion, can pave the way for a more dynamic, competitive, and cost-effective defense market.

Keep building,

Andrew