A few months ago, I set to task mapping out the defense-focused and dual-use technologies (private) market.

As you can imagine, that’s a pretty big undertaking.

There are tons of small, non VC-backed companies that are providing goods and services to the government and defense.

I wanted to focus on the high-growth technologies that are VC-backable, to understand how private capital could make an impact early and quickly, shoring up our national defense.

But before I get to the map, let’s cover some other ground first.

This edition on mapping the defense tech market is part of a larger series on the role of private capital (really, venture capital) in supporting Defense.

If you haven’t already done so, consider going back to read the previous editions:

On Fleas and Elephants: Understanding the Time it Takes to Build in Defense

Private Industry is Eating the Government: Who is advancing technology and who is funding it?

Inflection Points: Compounding Effects in a Rapidly Changed World

Symptoms of a Sick State: What the hell happened to the dynamic American economy?

Background / Methodology

While helping a prestigious, top-tier VC firm build out its defense technology investment program, I wanted a concise map that showed sub-sectors of defense technology and which startups were operating in those sub-sectors.

Plenty of great research institutions like CB Insights (fun note: the CB stands for ChubbyBrain, the company’s original “start-upy” name), Crunchbase, and PitchBook produce these sorts of maps.

So, I started by checking those usual suspects for an existing market map.

Unfortunately, after lots of digging, my search turned up nothing.

I realized that I would have to make one from scratch.

I started by listing out all of the companies that I was already aware of (which was plenty), including the SHARPEs.

As a refresher, the SHARPEs are the Defense-Tech unicorns including:

Palantir (not technically a unicorn as its publicly listed; as such, you won’t see it on my market map below)

After listing out the many companies I knew, I culled the list to just those that are VC-backable.

Then, I set out to find others.

I looked at the portfolios of the VC firms that I knew were investing in Defense Tech.

I went to AngelList (now WellFound) to see who was hiring.

I spent days on every major defense news publication like DefenseNews, BreakingDefense, Task & Purpose, and others to see who was being mentioned.

I talked to my network to find out what companies they were looking at.

What I found interesting was that I had a pretty good understanding of the defense-focused companies at the outset. But many of the dual-use companies were flying under my radar, with some really great use cases.

At the end, I had a spreadsheet with several hundred startups.

Once more I had to cull the list down a bit and this time I needed to start binning them into sub-sectors.

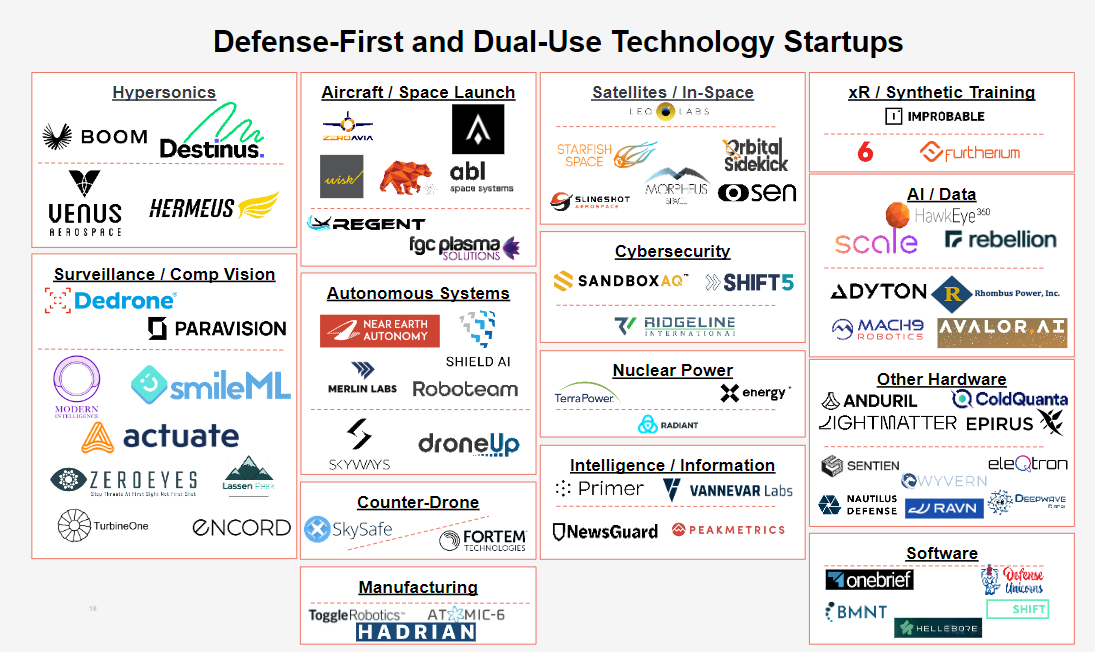

Those sub-sectors included hypersonics, aircraft and space launch systems, satellites and in-space services, synthetic training (including extended reality), data / AI services, robotics, manufacturing, nuclear power, cybersecurity, surveillance (many using computer vision), drone and counter-drone, information and counter-disinformation, and “other” hardware companies.

The final thing I needed to do was determine where in their journey each startup was, in terms of financing.

Almost there…

We’re almost to the map, I promise.

Before we get there though, I want to say that defense and dual-use technology are only recently of significant interest to many VCs (funny, as VC’s origins come from defense technology, but we’ll save that for another edition).

As such, my work mapping out the ecosystem was unprecedented.

Interestingly, though, since I completed my map, I’ve seen several others materialize. To me, this highlights the emerging interest in defense tech.

Michael Bloch of Quiet Capital posted a great market map last month.

Navneet Vishwanathan also created a great market map last month for his work with Columbia Venture Fellows.

(Similarly, Seraphim offers a great market map of the Space Industry)

I also recall seeing a European-focused defense tech market map in January. Unfortunately, I’m not able to find and share that one and give credit to its creator.

Nevertheless, Michael and Navneet’s maps are fantastic. You should look at them too.

The fact that there is a sudden emergence of multiple maps indicates that more people are taking this industry seriously. That’s good. So to preempt any questions, I’m not threatened by others working in parallel. Instead, I see it as a positive and look for future synergies with Michael, Navneet, and anybody else working in defense tech.

The Map

Without further ado or fanfare, here it is.

A few notes. This map was made in November and updated in December. Some companies may have moved around or wound-down operations. Also, new entrants appear all the time (which is super exciting). To my knowledge though, this map remains accurate, if imperfect.

If you recall, I mentioned culling the hundreds of companies down, resulting in this list of ~70 companies.

Each box represents a sub-sector in the larger defense tech / dual-use industry.

Within each box, there’s a dashed line. Companies above that line are Series B or later. Companies below that line are early stage. I arbitrarily set where that line fell, but think it’s a useful tool to understand the maturity and opportunities in each sub-sector.

Alright, take some time and digest the map. Drop me a comment to let me know who is missing from it. I will undoubtedly update it at some point in the next few months.

If you’re on the map, I want to say “thank you” for building something special that contributes to our national defense, quality of life, and protecting western liberal democratic values!

Keep Building!

Andrew