Magicians Never Show Their Trick Twice - Musk Should Learn That

Unpacking the Sleight of Hand Behind Merging X Corp. and AI Ambitions

Good morning,

About three months ago, Elon Musk performed a financial sleight of hand, folding the struggling X Corp into xAI to mask the social media platform’s losses. Now, the visionary showman is at it again.

Last week, xAI raised $10 billion—$5 billion in equity and $5 billion in debt—at a $113 billion valuation, bolstered by X Corp.’s acquisition. SpaceX, another Musk venture, chipped in $2 billion, despite xAI’s $1 billion monthly burn rate dwarfing its ~$41.7 million monthly revenue. While SpaceX integrates xAI’s Grok for Starlink customer support, this move smells like another of Musk’s shell games, shuffling funds across his empire.

But xAI isn’t stopping there. Rumors swirl of another $10 billion raise at a staggering $200 billion valuation—denied by Musk on X, yet still fueling speculation. How did xAI, whose Grok model barely cracked "Top 10" lists a year ago, achieve this meteoric rise?

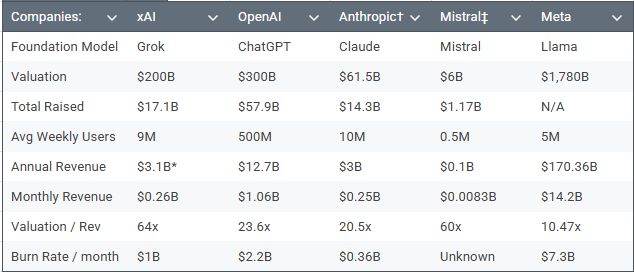

By merging X Corp. into xAI, Musk inflated revenues sixfold, from $500 million annually (without X) to an implied $3.1 billion, slashing the valuation-to-revenue multiple from 400x to 64x. This multiple, while high, isn’t without precedent in AI. The catch? xAI’s 9 million weekly users exclude X’s ~500 million, and its core AI revenue remains modest compared to OpenAI’s $1.06 billion monthly haul.

* xAI’s revenues have been marked-up to include global revenues from X, the social media platform. Without X, xAI’s annual revenue is ~$500M. The 9M weekly users does not include the ~500M weekly visitors to X.

† Claude’s web traffic is 2% of OpenAI’s, so we’ve extrapolated the avg weekly users. We’ve also taken an average of their annual 2024 burn rate ($5.6B) and their projected 2025 burn rate ($3B), raising their expected burn rate.

‡ Mistral’s revenues may be underreported.

Musk’s formula—hype, aggressive fundraising to match OpenAI, and blending X’s social media revenue with xAI’s AI potential—has pushed valuations to the edge of credibility. A more grounded estimate would value xAI at $54 billion: $15 billion for AI revenue at 30x (above the ~27x median) and $39 billion for X’s ad revenue at 15x (well above the ~2.5x median).

Musk’s genius lies in selling grand visions, but borrowing from SpaceX to prop up xAI echoes his past playbook of blurring business lines. This high-stakes bet could make xAI a leader if Grok leverages X’s data to outpace rivals. Yet, with a $13 billion annual burn and X’s $13 billion debt, the line between innovation and financial juggling grows thin. Investors may buy the dream, but time will tell if Musk’s empire can sustain the weight of its ambitions.

Oh, and we almost forgot. xAI’s Grok asks “WWED” or “What would Elon do?” before answering controversial questions now.

Alright, let’s move on to the news!

News Headlines

Senate panel pushing DOD on strategy to deter Chinese cyber activity on critical infrastructure (DS)

SASC wants DoD to explore 'tactical' cyber employment (DS)

US threatened 30% tariffs on EU and Mexico (BBC)

EU is ready to retaliate but still wants trade deal

Trump announces new U.S. support to Ukraine because Putin 'talks nice, then bombs everybody' (FX)

New Caledonia gains statehood, remains French—at least for now (AlJ)

Iran expels 4 million Afghans (AlJ)

Japan breaks internet speed record with 1.02 Pbps -- 4 million times faster than average U.S. broadband speed (ET)

Quantum Tech

HYPERSPACE initiative seeks to beam quantum data from Europe to Canada using quantum communications (QI)

Quantum battery device extends lifetime 1000x (QI)

Multidimensional photonic computing—encoding data across multiple properties of light such as wavelength, polarization, etc—enables highly parallel processing with reduced latency (QI)

AI / ML

Cyber Command seeks $5M for data standards project in FY26 budget (DS)

TRANSCOM pursues AI to enhance mass casualty response and patient movement operations (DS)

AI slows down some experienced software devs, study finds (RT)

Imposter uses AI to impersonate Rubio and contact foreign and U.S. officials (AP)

OpenAI, Microsoft, and Anthropic partnered with biggest teachers union to bring AI to classrooms (PRN)

OpenAI poached four execs from Tesla, xAI, and Meta (WI)

NanoTech / Chips

Congress renews push to stop Chinese AI chip smuggling (HR)

Report suggests that high-end forecasts on data centers aren't credible; there're too few AI chips (UD)

Huawei AI chip redesign aims to break Nvidia's China dominance (TI)

Deal Flow

Funds

Ex-Sequoia partner Matt Miller is set to launch UK-based VC firm Evantic Capital with $400M focused on Series B investments into AI and tech infra (PB)

University of Tokyo Edge Capital Partners (UTEC), a Japanese VC firm specializing in STEM startups, raised $326M for its sixth fund (TIA)

Israel, U.S. plan joint $200M quantum fund with potential Arab state collaboration (JP)

VC

Musk's AI and social media platform xAI is reportedly in talks to raise $10B at a ~$200B valuation led by Saudi's PIF (RT)

xAI raised a $2B investment from Musk's SpaceX (WSJ)

Amazon is considering another multibillion-dollar investment in AI startup Anthropic (RT)

AI chip startup Groq is in talks to raise $300M-$500M at a $6B post-money valuation (RT)

XPANCEO, a Dubai-based deep tech developing the world's first multifunctional smart contact lens, raised a $250M Series A at a $1.35B valuation led by Opportunity Venture (TFN)

SiPearl, a startup building European processors, raised a $152M Series A extension led by Cathay Venture, EIC Fund, and France 2030 (PU)

Data privacy solutions provider Didomi raised a $71.5M round led by Marlin Equity Partners (EUS)

RealSense, a startup building cameras that use stereoscopic imaging to enhance machines’ perception of the physical world, raised a $50M Series A from Intel Capital and others after spinning out from Intel (TC)

Arbor Energy, a startup building a plant to burn waste biomass for electricity in a data center, received $41M from Frontier (LM)

AI chip startup Arago raised a $26M seed round led by Earlybird, Protagonist, and Visionaries Tomorrow (TEU)

Vellum, an enterprise development platform for building and deploying mission-critical AI products, raised a $20M Series A led by Leaders Fund (AX)

QuiX Quantum Quantum, a Dutch startup developing photonic quantum computing hardware, raised a $17.5M Series A led by Invest NL and EIC Fund (QI)

AirMDR, an AI-native managed detection and response platform, raised a $15.5M seed round led by Race Capital (BW)

AI agentic startup Gradient Labs raised a $13M Series A led by Redpoint Ventures (TEU)

Knox, a FedRAMP-as-a-service platform provider, raised a $6.5M seed round led by Felicis (TC)

Public policy-focused AI startup Helios raised a $4M seed round led by Unusual Ventures (TC)

PE / M&A / Exits

OpenAI completed its $6.5B all-stock acquisition of AI device startup io Products, co-founded by ex-Apple design chief Jony Ive (TV)

Meta acquires a minority stake in EssilorLuxoticca for $3.5B for AR innovation (WPN)

Google agreed to pay ~$2.4B for talent and licensing rights from AI coding startup Windsurf after OpenAI's $3B acquisition of Windsurf collapsed (RT)

Stonepeak Partners is in talks to invest over $1B in Warburg Pincus-backed data center operator Princeton Digital Group (PEI)

Meta acquired voice AI startup PlayAI (TC)

Chinese OpenAI rival Zhipu is considering shifting its planned IPO from China to Hong Kong to raise ~$300M with backing from Alibaba and Tencent (BBG)

Opportunities

The National Institute of Standards and Technologies has a small business set-aside for the development of essential networking protocols, measurement techniques and measurement tools for quantum networking (SAM)

NATO is seeking proposals for AI support to modeling and simulation life cycle (ACT)

Lighter Side

Keep Building,

BOF